- موضوعات پیشنهاد شده برای پایان نامه رشته مدیریت بانکداری:

- بررسی رابطه شهرت حسابرس و مدیریت سود در صنعت بانکداری

- رابطه کارآفرینی سازمانی و عملکرد بانک ها

- بررسی رابطه شهرت بانک ها و نیات رفتاری مشتریان (نقش شناخت، اعتماد و تعهد)

- ارزیابی سرمایه فکری در صنعت بانکداری و ارتبط آن با عملکرد بانک ها

- بررسی رابطه تنوع پرتفوی وام های اعطایی با ریسک در سیستم بانکی

- بررسی رابطه تنوع پرتفوی وام های اعطایی با کارایی در سیستم بانکی

- بررسی رابطه تنوع پرتفوی وام های اعطایی با سرمایه گذاری در سیستم بانکی

- طراحی مدل تلفیقی کارت امتیازی متوازن (BSC) و تصمیم گیری چندمعیاره فازی (FMADM) جهت ارزیابی عملکرد سیستم بانکی

- طراحی مدل تلفیقی کارت امتیازی متوازن (BSC) و تحلیل شبکه ای (ANP) جهت ارزیابی عملکرد مدیریت دانش سیستم بانکی

- رابطه قابلیت های سازمانی و عملکرد سیستم هزینه یابی بر مبنای هدف

- طراحی مدلی جهت مکان یابی بهینه شعب بانک با استفاده از روش تحلیل سلسله مراتبی فازی

- بررسی تاثیر خصوصی سازی بر مدیریت سود بانک ها (مطالعه موردی بانک …)

- بررسی رابطه بین مدیریت سود و کیفیت سود بانک ها (مطالعه موردی بانک …)

- بررسی رابطه ویژگی های کیفی سود (پایداری سود، قابلیت پیش بینی سود، به موقع بودن سود، محافظه کار بودن سود و مربوط بودن سود به ارزش سهام) با عملکرد شرکت ها

- بررسی رابطه سرمایه در گردش و سودآوری بانک ها

- بررسی رابطه سرمایه در گردش و بازده سهام بانک های بورسی

- شناسایی و اولویت بندی عوامل موثر بر پیاده سازی موفق مدیریت ارتباط با مشتری CRM در صنعت بانکداری

- طراحی مدل بهینه مدیریت الکترونیکی روابط با مشتریان (ECRM) در بانک ها

- ارائه مدلی جهت سنجش و کمی سازی ارزش ویژه برند در صنعت بانکداری

- بررسی عوامل موثر بر ارزش ویژه برند در صنعت بانکداری

- بررسی رابطه ارزش ویژه برند و عملکرد بانک ها

- رتبه بندی اعتباری مشتریان با استفاده از ابزار داده کاوی

- محاسبه نرخ تمرکز صنعت بانکداری (بانک های دولتی و خصوصی) و بررسی ارتباط آن با سودآوری بانک ها

- بهینه سازی مدیریت ارتباط با مشتری (CRM) با استفاده ار تکنیک داده کاوی

- پیش بینی میزان سپرده های بانک با استفاده از روش شبکه عصبی و آریما و مقایسه نتایج

- بررسی تاثیر ریسک های بانکی (عملیاتی،اعتباری، نقدینگی و بازار) بر عملکرد بانک های کشور

- ارزیابی عملکرد بانک ها از بعد ریسک اعتباری با مدل DEA

- شناسایی و رتبه بندی شاخص های موفقیت اجرای مدیریت دانش بانک با استفاده از مدل PLS

- ارزیابی عملکرد مدیریت دانش با استفاده از AHP (یا AHP فازی)

- بررسی رابطه مدیریت دانش و متغیرهای محیطی سازمان با ساختار سازمانی (موردی بانک …)

- بررسی رابطه استراتژی های مدیریت دانش و عملکرد (موردی بانک …)

- تدوین استراتژی بهینه منابع انسانی (موردی بانک …)

- بررسی رابطه بین سبک های مدیریت تعارض و کارایی و اثربخشی سازمان (موردی بانک …)

- بررسی رابطه بین سبک های مدیریت تعارض و فرهنگ سازمان (موردی بانک …)

- بررسی رابطه بین سبک های مدیریت تعارض و تعهد سازمان (موردی بانک …)

- شناسایی و اولویت بندی استراتژی های توانمندسازی منابع انسانی (موردی بانک …)

- بررسی رابطه بین توانمندسازی منابع انسانی و اثربخشی سازمان (موردی بانک …)

- بررسی رابطه بین توانمندسازی منابع انسانی و فرهنگ سازمان (موردی بانک …)

- بررسی رابطه بین توانمندسازی منابع انسانی و تعهد سازمان (موردی بانک …)

- بررسی رابطه بین توانمندسازی منابع انسانی و کارایی سازمان (موردی بانک …)

- رابطه شهروندی سازمانی با سودآوری (موردی بانک …)

- رابطه عدالت سازمانی با سودآوری (موردی بانک …)

- رابطه شهروندی سازمانی و عملکرد سازمان (موردی بانک …)

- رابطه مدیریت مشارکتی و فرهنگ سازمانی (موردی بانک …)

- مدیریت مشارکتی و اثربخشی و کارایی سازمانی (موردی بانک …)

- ارزیابی عملکرد منابع انسانی با رویکرد کارت امتیازی متوارن BSC

- بررسی عوامل موثر در حفظ پایداری منابع انسانی

- بررسی ارتباط کیفیت گزارشگری مالی و تصمیم گیری مدیران

- بررسی رابطه ویژگی های کیفی سود (پایداری سود، قابلیت پیش بینی سود، به موقع بودن سود، محافظه کار بودن سود و مربوط بودن سود به ارزش سهام) با عملکرد (موردی بانک …)

- ارزیابی سرمایه فکری در صنعت بانکداری و ارتباط آن با عملکرد بانک ها

- رابطه قابلیت های سازمانی و عملکرد سیستم هزینه یابی بر مبنای هدف

- تبیین رابطه کارایی و عملکرد (بازده) سهام بانک های خصوصی

- طراحی مدل های جدید (E-S-Qual) و (E-RecS-Qual) جهت سنجش کیفیت خدمات بانکداری اینترنتی

- Optimal Inflation Targets and the Role of the Central Bank in Albania (2011) Loan Loss Provisioning in the Commercial Banking System of Barbados: Practices and Determinants (2011)

- Impact of Corporate Governance on Firm Performanc Evidence from the Tobacco Industry of Pakistan (2011)

- Impact of Audit Quality on Earnings Management (2011)

- Government Ownership and Performance of MalaysianGovernment-Linked Companies (2011)

- Financial Performance Evaluation of Some Selected Jordanian Commercial Banks (2011)

- Determinants of Dividend Policy of Banks in Ghana (2011)

- Acquisition Activities of Public Sector Banks in India and its Impact on Shareholders’ Wealth (2011)

- Determinants of Corporate Capital Structure Under Different Debt Maturities (2011)

- Factors Influencing the Profitability of Conventional Banks of Pakistan (2011)

- Impact of Audit Quality on Earnings Management (2011)

- The Effects of Bank Capital on Lending:What Do We Know, and What Does It Mean? (2011)

- The Impact of Corporate Governance on Auditor Choice (2011)

- The Impact of Organizational Culture on Knowledge Sharing: The Context of Jordan’s Phosphate Mines Company (2011)

- Loan Loss Provisioning in the Commercial Banking System of Barbados: Practices and Determinants (2011)

- Examining The Capital Structure Determinants: Empirical Analysis of Companies Traded on Abu Dhabi Stock Exchange (2011)

- Banking Crisis and Financial Stability in Nigeria (2011)

- The Impact of Working Capital Efficiency on Profitability– an Empirical Analysis on Jordanian Manufacturing Firms (2011)

- The impact of bank ownership concentration on impaired loans and capital adequacy (2010)

- Capital structure, equity ownership and firm performance (2010)

- Impact of intellectual capital on organisational performance (2009)

- Interest rates and bank risk-taking (2011)

- The effects of loan portfolio concentration on Brazilian banks’ return and risk (2011)

- Capital ratios and the cross-section of bank stock returns: Evidence from Japan (2011)

- Banks total factor productivity change in a developing economy: Does ownership and origins matter? (2011)

- The impact of taxation on bank profits: Evidence from EU banks (2011)

- Bank size, market concentration, and bank earnings volatility in the US (2011)

- The impact of management and board ownership on profitability in banks with different strategies (2011)

- Bank size and risk-taking under Basel II (2011)

- Capital requirements and bank behavior in the UK: Are there lessons for international capital standards? (2011)

- Modelling the effect of national culture on multinational banks’ performance: A conditional robust nonparametric frontier analysis (2011)

- Interest rates and bank risk-taking

- Bank monitoring, profit efficiency and the commercial lending business model

- Banks’ regulatory capital buffer and the business cycle: Evidence for Germany

- The effects of loan portfolio concentration on Brazilian banks’ return and risk

- Capital ratios and the cross-section of bank stock returns: Evidence from Japan

- Banks total factor productivity change in a developing economy: Does ownership and origins matter? The impact of taxation on bank profits: Evidence from EU banks

- Bank size, market concentration, and bank earnings volatility in the US

- The impact of management and board ownership on profitability in banks with different strategies

- Bank size and risk-taking under Basel II

- Capital requirements and bank behavior in the UK: Are there lessons for international capital standards?

- Modelling the effect of national culture on multinational banks’ performance: A conditional robust nonparametric frontier analysis

- Modelling the effect of national culture on multinational banks’ performance: A conditional robust nonparametric frontier analysis

- A Framework for Evaluating the Effectiveness of Information Systems at Jordan Banks: An Empirical Study

- A NOTE ON MANAGEMENT EFFICIENCY AND INTERNATIONAL BANKING. SOME EMPIRICAL PANEL EVIDENCE

- Accounting and capital market measures of risk: Evidence from Asian banks during 1998–۲۰۰۳

- An Innovative Spreadsheet Authoring Environment

- Applying enhanced data mining approaches in predicting bank performance: A case of Taiwanese commercial banks (2009)

- Assessing output and productivity growth in the banking industry

- Assessing the efficiency in operations of a large Greek bank branch network adopting different economic behaviors

- Asset prices and banking distress: A macroeconomic approach

- Auditor reputation and earnings management: International evidence from the banking industry

- Bank ownership type and banking relationships

- Bank stock returns and economic growth

- Banking crisis and productivity of borrowing firms: Evidence from Japan

- Corporate choice of banks: Decision factors, decision maker, and decision process (2010)

- Demand estimation and consumer welfare in the banking industry

- Differential impact of Korean banking system reforms on bank productivity

- Does bank ownership increase firm value? (Evidence from China)

- Entrepreneurial finance: Banks versus venture capital

- Evaluating the state of competition of the Greek banking industry

- Financial reforms and time-varying microstructures in emerging equity markets

- How to Gauge the Credit Risk of Bank Loans: Evidence from Taiwan

- Information asymmetry and the value of cash

- Internet Banking Adoption Among Young Intellectuals

- INTERNET BANKING IN INDIA-A STEP TOWARDS FINANCIAL INCLUSION

- Ownership Structure, Risk and Performance in the European Banking Industry

- Risks in Large Value Payment Systems

- The Analysis of Taiwanese Bank Efficiency: Incorporating both External Risk and Internal Risk

- The Economics of Islamic Finance and Securitization

- The effects of reform on China’s bank structure and performance

- The impact of regulatory reforms on cost structure, ownership and competition in Indian banking

- The Influence of Trust on Internet Banking Acceptance

- What determines the banking sector performance in globalized financial markets? The case of Turkey

- A comprehensive analysis of the effects of risk measures on bank efficiency: Evidence from emerging Asian countries

- A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard (2009)

- A genetic programming model for bankruptcy prediction: Empirical evidence from Iran (2009)

- An evaluation of alternative scoring models in private banking (2009)

- Association of DEA super-efficiency estimates with financial ratios: Investigating the case for Chinese banks (2011)

- Bank modelling methodologies: A comparative non-parametric analysis of efficiency in the Japanese banking sector

- Bank ownership and executive perquisites: New evidence from an emerging market (2010)

- Bank ownership reform and bank performance in China (2009)

- Bankruptcy prediction in banks and firms via statistical and intelligent techniques-a review (2007)

- Benchmarking firm performance from a multiple-stakeholder perspective with an application to Chinese banking (2010)

- Comparing the performance of market-based and accounting-based bankruptcy prediction models

- Cost efficiency, economies of scale, technological progress and productivity in Indonesian banks

- Credit risk assessment with a multistage neural network ensemble learning approach (2008)

- Determinants of banks’ risk exposure to new account fraud – Evidence from Germany

- Efficiency analysis of cross-region bank branches using fuzzy data envelopment analysis

- Efficiency and stock performance of EU banks: Is there a relationship?

- Equity Ownership Structure, Risk-Taking and Performance: An Empirical Investigation in Turkish Companies

- First Financial Restructuring and Operating Efficiency: Evidence from Taiwan Commercial Banks

- Fuzzy performance evaluation in Turkish Banking Sector using Analytic Hierarchy Process and TOPSIS (2009)

- Genetic programming for credit scoring: The case of Egyptian public sector banks (2009)

- How loan portfolio diversification affects risk, efficiency and capitalization: A managerial behavior model for Austrian banks

- Intellectual Capital: Acquisition and Maintenance: The Case of New Zealand Banks

- Intellectual Capital: Acquisition and Maintenance: The Case of New Zealand Banks (2008)

- Managers and efficiency in banking

- Market structure, conduct and performance: Evidence from the Bangladesh banking industry

- Multiple goals and ownership structure: effects on the performance of Spanish savings banks (2008)

- Optimizing the Use of Information and Communication Technology (ICT) in Nigerian Banks

- pening the black box of efficiency analysis: an illustration with UAE banks (2009)

- Predicting Japanese bank stock performance with a composite relative efficiency metric: a new investment tool (2010)

- The effect of capital wealth on optimal diversification: Evidence from the Survey of Consumer Finances

- The effects of focus versus diversification on bank performance: Evidence from Chinese banks

- The impact of bank ownership concentration on impaired loans and capital adequacy

- The impact of banking sector reform in a transition economy: Evidence from Kyrgyzstan

- The Impact of E-Commerce Security, and National Environment on Consumer adoption of Internet Banking in Malaysia and Singapore

- The impact of non-traditional activities on the estimation of bank efficiency: international evidence

- Using neural networks ensembles for bankruptcy prediction and credit scoring (2008)

- Managers and efficiency in banking

- Bank ownership type and banking relationships

- Does bank ownership increase firm value? Evidence from China

- Bank stock returns and economic growth

- Differential impact of Korean banking system reforms on bank productivity

- Market structure, conduct and performance: Evidence from the Bangladesh banking industry

- The effects of focus versus diversification on bank performance: Evidence from Chinese banks

- Efficiency and stock performance of EU banks: Is there a relationship?

- Assessing output and productivity growth in the banking industry

- Assessing the efficiency in operations of a large Greek bank branch network adopting different economic behaviors

- Auditor reputation and earnings management: International evidence from the banking industry

- Bank modelling methodologies: A comparative non-parametric analysis of efficiency in the Japanese banking sector

- Determinants of banks’ risk exposure to new account fraud – Evidence from Germany

- Efficiency analysis of cross-region bank branches using fuzzy data envelopment analysis

- Financial reforms and time-varying microstructures in emerging equity markets

- How loan portfolio diversification affects risk, efficiency and capitalization: A managerial behavior model for Austrian banks

- Intellectual Capital: Acquisition and Maintenance: The Case of New Zealand Banks

- Optimizing the Use of Information and Communicatio Technology (ICT) in Nigerian Banks

- Accounting and capital market measures of risk: Evidence from Asian banks during 1998–۲۰۰۳

- Asset prices and banking distress: A macroeconomic Approach

- Evaluating the state of competition of the Greek banking industry

- The impact of banking sector reform in a transition economy: Evidence from Kyrgyzstan

- The Impact of E-Commerce Security, and National Environment on Consumer adoption of Internet Banking in Malaysia and Singapore

- The impact of regulatory reforms on cost structure, ownership and competition in Indian banking

- The Influence of Trust on Internet Banking Acceptance

- What determines the banking sector performance in globalized financial markets? The case of Turkey

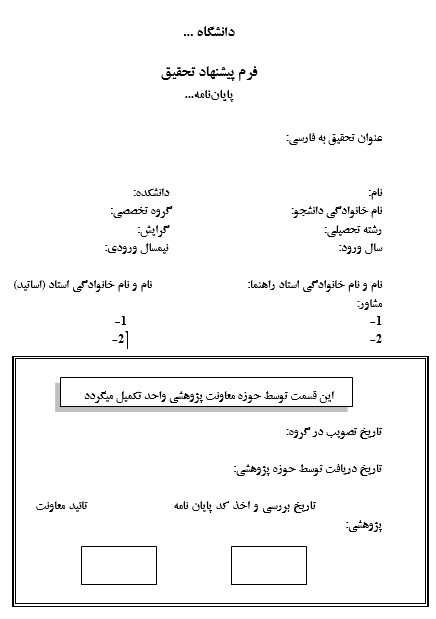

رشته های مقطع کارشناسی - پایان نامه ها - فرآیند استخراج مقاله از پایان نامه